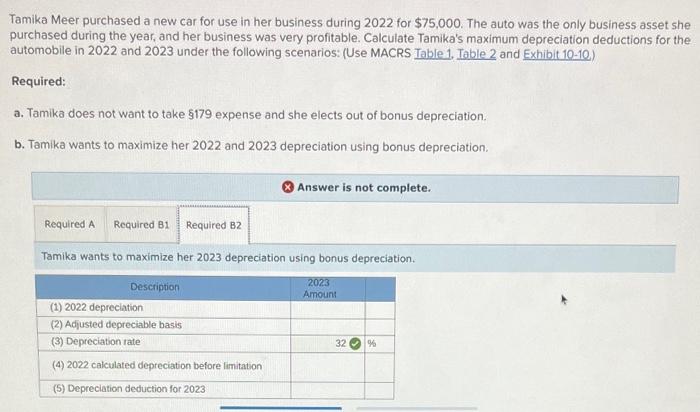

Business Vehicle Depreciation 2024 Limits – The IRS issued the 2024 depreciation limitations for passenger automobiles, including those for which bonus depreciation is applied. . It allows business for 2024 ($28,900 for 2023). You may be able to use bonus depreciation for the remaining cost. If you take a Section 179 deduction or depreciation deduction for a vehicle .

Business Vehicle Depreciation 2024 Limits

Source : www.jeep.comReducing Your Taxes With Section 179

Source : insights.am-ind.comSection 179 & More Business Vehicle Tax Deductions | Jeep

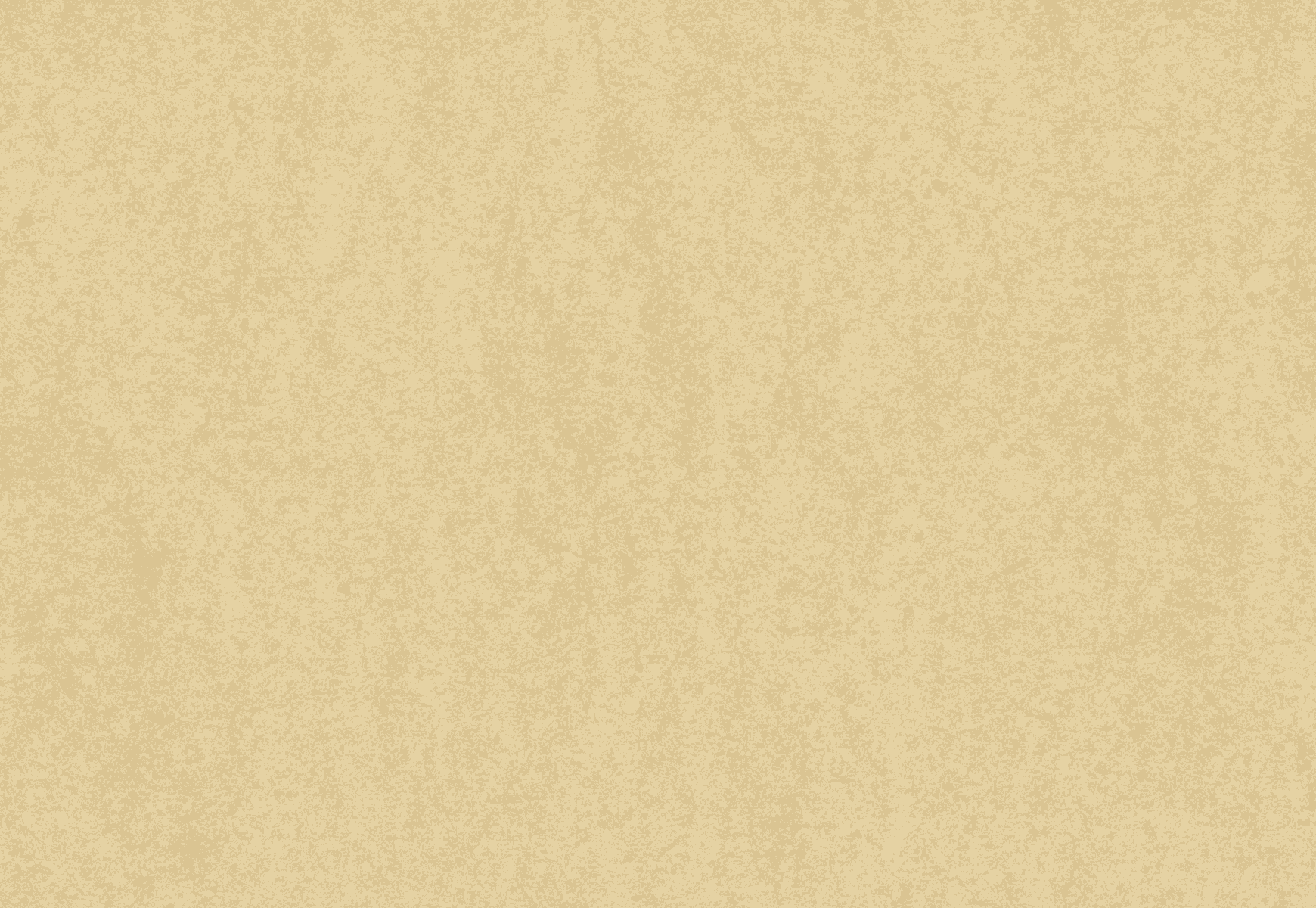

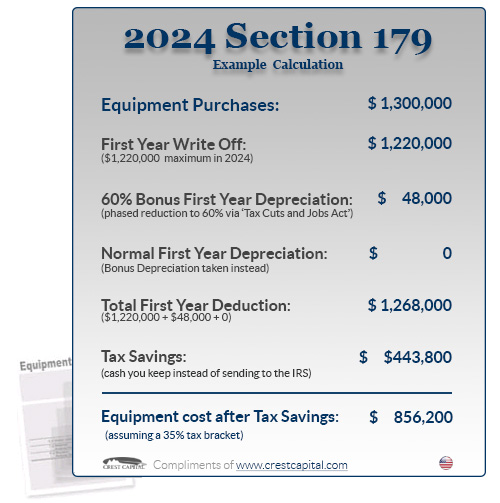

Source : www.jeep.comSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.comSection 179 Deduction – Section179.Org

Source : www.section179.orgSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.comLittleOwl CPA, Inc. | Atlanta GA

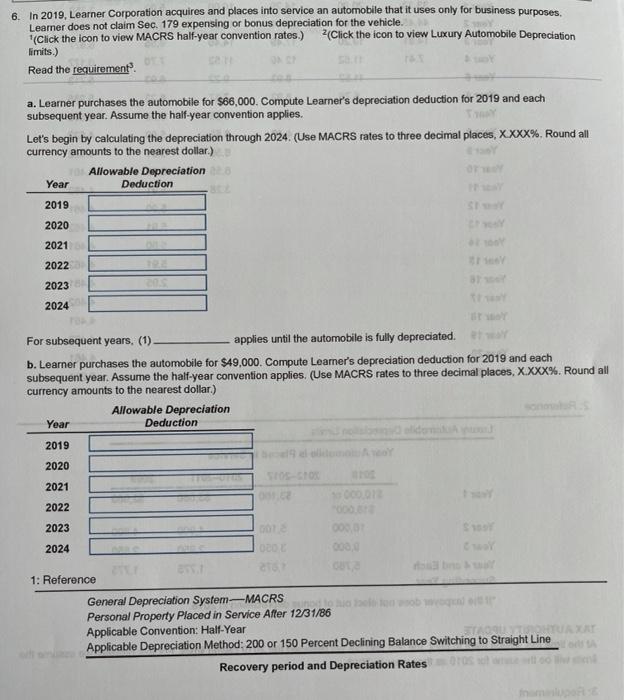

Source : www.facebook.comSolved 6. In 2019, Learner Corporation acquires and places | Chegg.com

Source : www.chegg.comJack McNerney Chevrolet is a TULLY Chevrolet dealer and a new car

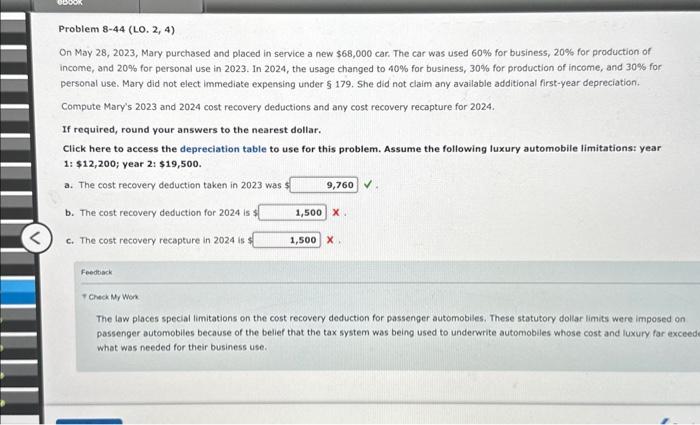

Source : www.jackmcnerneychevrolet.comSolved On May 28,2023 , Mary purchased and placed in service

Source : www.chegg.comBusiness Vehicle Depreciation 2024 Limits Tax Benefits For Your Small Business With Jeep® Vehicles: Four years after COVID emerged, vehicle prices are easing down amid some supply kinks, electric vehicle uncertainty, rising operational costs, and AI potential. . When buying a car for your business, consider what optional extras are imperative for you, if any. Extras can bring practical benefits, limit depreciation and potentially boost vehicle safety — which .

]]>